Money Talks || Why you shouldn’t save in a traditional piggybank.4 mins read

Hey there!

Do you save part of your income? How do you do that? Do you save in a traditional piggybank? Whatever your answers might be, just read on, I have gist for you.

Before getting into the post proper, I’ll be sharing some backstory about how this idea came to be. Stay with me.

Over the past few weeks, I’ve been struggling with whether or not to delve into writing about personal finance. The idea was particularly inspired by a message I received from an old classmate reminding me of when I helped her save money back in secondary school.

I had contemplated starting this series a while back, but somehow I couldn’t bring myself to. I didn’t want to feel like a fraud because although I follow most of the principles I’ll be talking about, I’m not as diligent/consistent as I would love to be. But I guess talking about it and encouraging people to adopt it might give that extra push I need, abi?

After a lot of back and forth, I decided that sometimes you just have to do what you have to do! Ready or not. So while I might not be a ‘finance girl’ or an expert on money matters, I sure do have some things I’ve picked up over the years which I feel could be useful to more people beyond my friends and those on my contact list.

I’m also praying (and doing my own part) that my account cooperates and blossoms even as I share these tips. Because how awkward will it be if I stay broke while sharing money tips?? Too awkward.

Enough pre-gist. Let’s get into the main gist of the day.

In this introductory post, I’d be talking about saving inside wooden piggybanks aka ‘kolo’ and why it’s not an ideal set up.

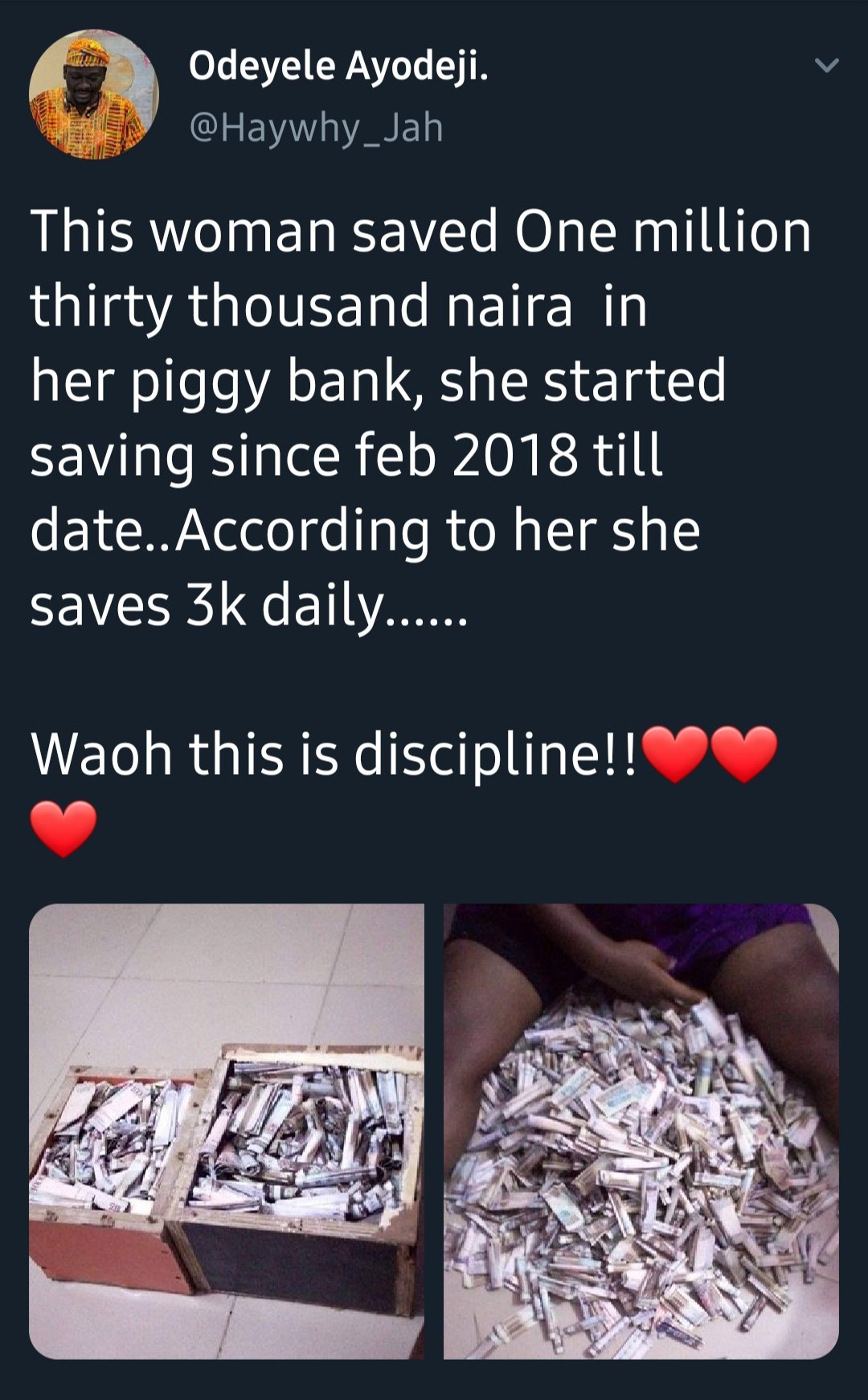

A while back, I saw a tweet about a woman who saved N3,000 daily over a period of 14 months. It was an impressive sight, seeing her sitting with her one thousand naira notes all around her.

(I understand that she might have had her personal reasons for saving this way. I’m only using this as a case study for educational purposes.)

My first thought was that this woman allowed her money to sit idle for too long – I’ll explain further about that in this post. That was actually my second thought. My real first thought was how she managed to have the money intact, with the different stories of money ‘disappearing’ from such wooden piggybanks going around. People say this happens, never happened to me though (I’ve never really had one).

I decided to ask if people really fancied seeing their cash as opposed to having it in a bank or some sort of investment. I got this response below.

Later during the week, I saw a post about an interview with Aliko Dangote, Africa’s richest businessman. He stated in the interview how he once withdrew 10 million dollars just to believe he had money.

But here’s the thing about Mr Aliko, he put the cash back where it belonged – in a bank working for him.

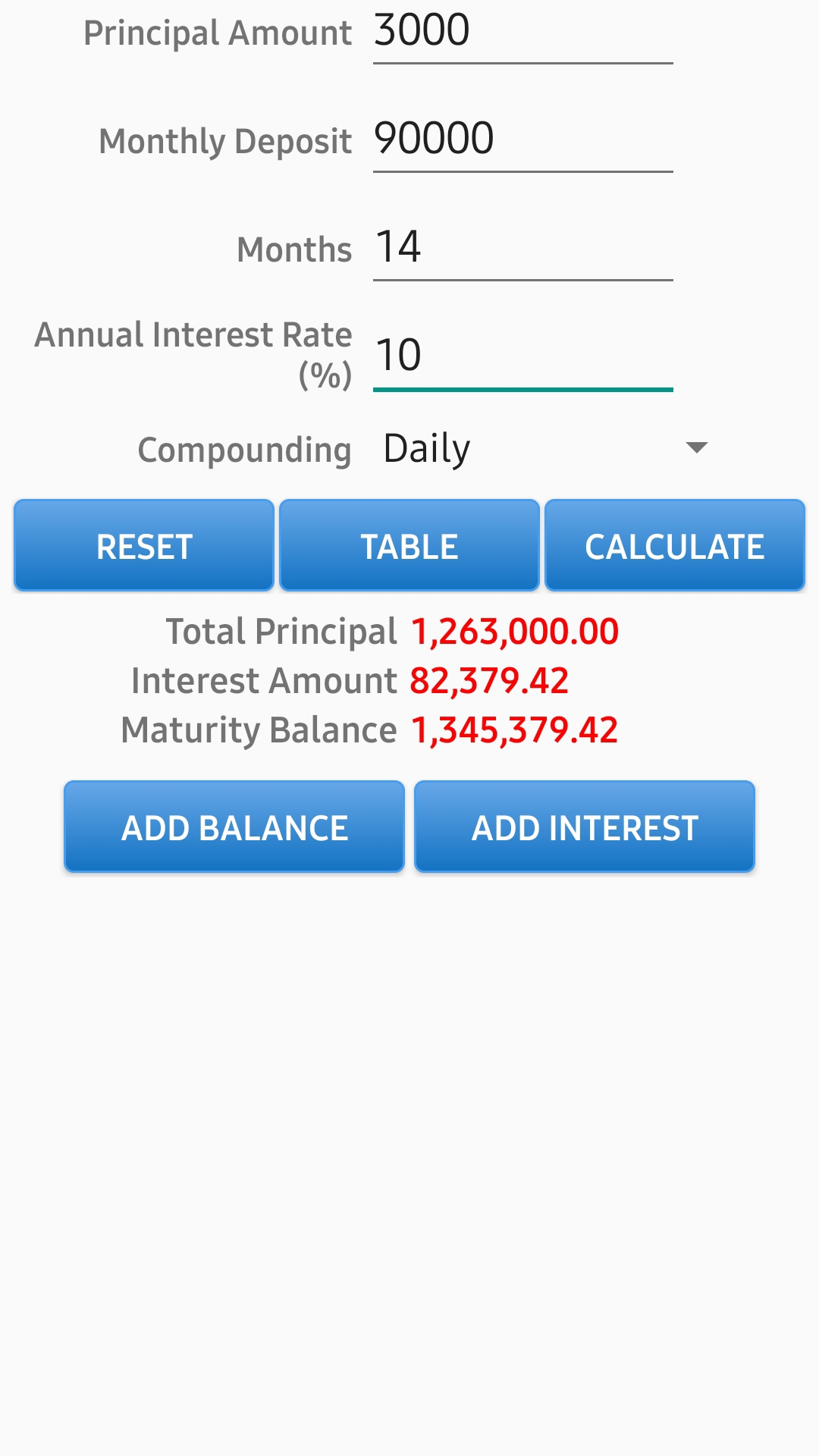

The reason why I had qualms with that lady’s method of saving is that she could have earned more if she had put the money to work. At an interest rate of as little as 10% per annum, compounding daily, she would have had more than she saved. But since she didn’t put the money to work, she got just exactly what she saved.

Saving in an interest giving platform rather than a kolo also helps preserve your money against inflation. The value of N1,000 this year, is most likely less than what it was a year or 2 ago. So if you’re saving in kolo, the 2 million naira saved over 2 years may have a lesser value at the time of use.

Saving on such platforms also makes money available for investments and other profitable actions which wouldn’t have been possible with the money docile in a piggy bank in your room. So, you’ll be helping the economy as well, not just yourself.

I hope I’ve been able to enlighten you about why saving using an interest giving platform is better?

In case you want to start saving on a different platform, here’s an online saving and investment platform which makes savings easy and fun. People have had good experiences using it. You can check it out here. There are other platforms out there as well which you can explore.

Over the next few weeks, I’ll be sharing more tips concerning saving and investing. Kindly subscribe to this space so you don’t miss any of the posts.

Did you find this post enlightening? Educative? Fun? Will you like to see more posts like this? Please let me know in the comment section.

P.S: To be honest, I sometimes have issues coming up with an appropriate opening for my posts, and seeing as this is a new kind of post on here it made it sort of harder. I decided to go with hey there! Kinda like calling your attention to this post. It worked right? Right! 😊

2 Comments

Anita

I can identify with feeling like one isn’t practising enough of what they know or isn’t as consistent or much of an expert to share what they know. I am glad you beat the thought and shared anyway.

Reading this woman’s story made me think of the wicked servant in the Bible that buried his talent. A sad way to save. I don’t recommend it at all.

yemikunmi.o

I know right! Thanks for sharing your thoughts.